Located along a strategic international trade route that connects Africa, the Middle East, Europe and Asia, Djibouti’s economic development has been linked with rising global commerce. In order to fully harness its geographic advantages and maintain its competitiveness, the country is now focusing on infrastructure improvements and a gradual diversification of its economy. This will require considerable amounts of foreign investment over the coming years, but it will also depend on support measures for private sector development, as well as a careful balancing of the state budget. However, so far the small country has managed to successfully maintain a robust growth rate – in spite of the turbulence of global markets, including the low oil price, the rising US dollar and the slowing Chinese economy – which bodes well for its near- and medium-term outlook.

Drivers & Bottlenecks

Economic expansion of the Djiboutian economy is being galvanized by a set of factors that are sustaining a dynamic of growth and improving the country’s attractiveness for foreign direct investment (FDI). Growth in neighboring Ethiopia – for which Djibouti is the primary gateway, handling 90% of its 95m-person neighbor’s trade – along with the rise of Chinese investment in Africa and a strategic location that has prompted the US, French, Japanese and Chinese militaries to establish permanent bases, are all positively impacting growth. Combined, these three elements are set to drive the country’s economy and international positioning over the coming years. Economic expansion will be essential for the country of 850,000. Poverty reduction continues to require robust government attention, and securing sufficient water and energy distribution will be key for long-term development.

The government has sought to tackle these issues, rolling out a number of ambitious infrastructure and human development plans, which aim to improve on Djibouti’s natural assets to broaden the number of economic sectors the country can depend on in the future. The plans all form part of the Djibouti Vision 2035 strategy, launched by the government in 2014, with the aim of maintaining the current growth momentum and developing the country into a regional trade and financial center. This overarching development structure is set to be implemented in successive five-year plans. The first of these, the Strategy for Accelerated Growth and Employment Promotion (Stratégie de Croissance Accélérée et de la Promotion de L’Emploi, SCAPE), was launched in 2015 and aims to frame the current assortment of investment and growth schemes under a broader approach, with a focus on boosting development by improving employment, health provision and basic services delivery for the 2015-19 period.

Indicators

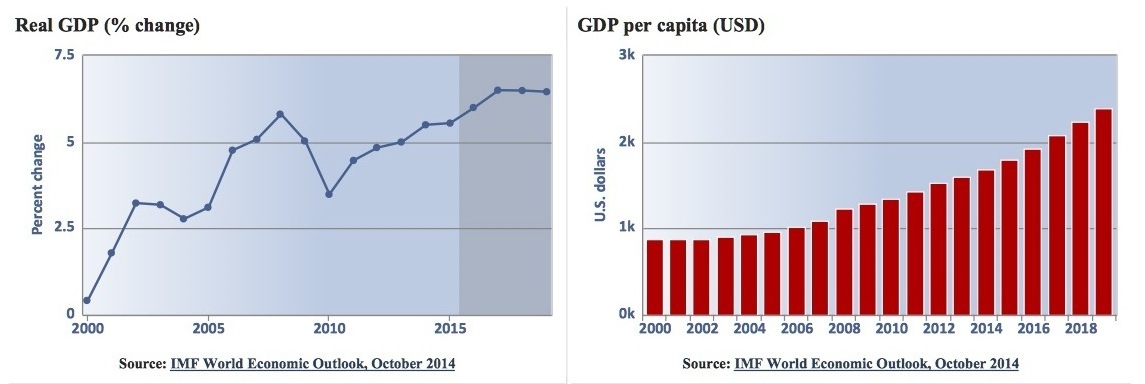

While the global economy has suffered from a rising measure of uncertainty in recent months, Djibouti’s economy has been posting robust growth figures, which have pointed to a steady acceleration of activity. Between 2006 and 2014 GDP climbed from $768m to $1.6bn, according to World Bank Figures. According to figures by the IMF, the Djiboutian economy grew 5% in 2013 and 5.9% in 2014. Growth for 2015 is estimated to settle at 6%, and maintain an upwards trend. The IMF expects GDP to expand by 6.5% in 2016, and grow at an annual rate of 7% between 2017 and 2019. Securing adequate living standards for all Djiboutians has so far remained a challenge, as 42% of the population lives in extreme poverty and 48% of the population is unemployed. The gross national income per capita was $1045 in 2015, although the authorities hope to raise it to $12,746 by 2035. The informal sector plays an important role in the economy, with informal enterprises comprising 60% of all business activity in the country, according to the African Development Bank (AFDB).

Currency: Djibouti’s banking system, like many emerging and frontier markets, avoided much of the fallout of the sub-prime meltdown of 2008. It has benefitted from the country’s macroeconomic stability, fully convertible currency, a fixed exchange regime and free movement of capital.

The Djibouti franc has a fixed-exchange rate to the US dollar, at DJF177.63 per $1. Because of this, the central bank is charged with ensuring coverage for base money, which the IMF estimates will remain around the 105% mark over the 2015-19 period. Monetary stability has helped to attract foreign investors into the services sector. “The fixed-exchange rate, with the Djiboutian franc’s value fixed to the dollar is a great advantage for the country, and a relief for international investors, because they do not have to worry about currency devaluation when planning a major project.

Inflation has been kept relatively low in recent years. After a worldwide spike in 2008 which saw inflation in the country hit 12%, the rise in consumer prices has been markedly lower, coming in at 2.4% in 2013 and 2.9% in 2014. The IMF expects inflation to climb up to 3% to 3.5% range for the 2016-19 period. The rise will be the likely outcome of current capital spending, set to push demand for transport, housing and other services in the Djiboutian economy.

On the back of a rise in both capital investment and transport activity, Djibouti’s banking sector has seen considerable expansion in recent years. The most visible change has been the increase in the number of players in the market, which has led to an uptick in competitiveness and the expansion of products and services targeting local clients.

The increasingly robust regulatory role that is being adopted by the Central Bank of Djibouti (Banque Centrale de Djibouti, BCD) has led to the promulgation of various new rules – ranging from risk assessment frameworks and sharia compliance to regulations for new payment systems – which should help pave the way for increased retail and corporate activity.

Spending Led Growth

Relatively robust economic growth – at an average of between 5% and 6% over the past two years and with forecasts of up to 7% for the next two years – has allowed the country to attract a wave of inbound investment and spark activity in the construction and transport sectors, which comprise the largest parts of the secondary and tertiary sectors respectively.

Revenues

As a result of the high volume of spending, ensuring a stable and sustainable source of revenues is crucial. Djibouti has traditionally out- performed the African average in terms of tax collection, with tax revenues equal to around 20% of GDP on average – well above countries like Nigeria, Ghana or Kenya, which are often in the low to mid- teens. A number of pending tax reforms (see over- view) that are due to be unveiled in 2016 should help to ensure that number inches up further. In June 2015 Djibouti held a high-level tax conference as a prelude to passing much needed tax reform, which is set to take five years to implement.

Djibouti also benefits from a stream of revenues from the leasing of military bases to countries like the US and China. In 2014 Djibouti successfully raised the rent for the US military base from $38m to $63m a year, which will provide a boon for the treasury, while China’s planned base is expected to bring in around $100m a year.

A number of one-off measures will also help to expand revenues over the next couple of years, including a $50m grant from the Gulf Cooperation Council for debt service and capital spending, and the remnants of the funds raised from the partial privatization of the ports in 2013.

The country’s recent high headline growth rate – which has hovered between 6% and 6.5% over the past 24 months – combined with legislation changes has led to a significant rise in the number of commercial banks, from two in 2006 to 11 by 2014. The penetration of banking services has not unexpectedly also experienced a steep rise, going from 5% of the country’s adult population in 2007 to 20% in 2015, according to the BCD.

Key Figures

The regulatory change that made banking institutions increase their minimal capital achieved its goal. According to the BCD’s 2014 annual report, the average ratio between assets and liabilities in the sector was 11%, close to the BCD’s minimum solvability ratio of 12%. Credit allocation by the sector has progressed significantly.

Credit allocated to the private sector grew from 20% of GDP in 2005 to 29.5% of GDP in 2015, according to figures by the BCD. According to central bank figures quoted in international media, lending in Djibouti rose from DJF 38bn ($212.8m) in 2006 to DJF116bn ($649.6m) in 2014.